How an industry that “makes ship happen” is poised to become a carbon removal pioneer

“In innovations that are based on process need, everybody in the organization always knows that the need exists. Yet usually nobody does anything about it. However when the innovation appears, it is immediately accepted as ‘obvious’ and soon becomes ‘standard’ “

-Peter Drucker, Innovation and Entrepreneurship

Sometimes the solutions that we seek are just under our very noses, in seemingly innocuous places that only come into focus when you step back for a second. A case in point is exactly that for two industries: carbon removal and wooden pallets.

In this post I’ll take up the case of why the wooden pallet industry may be such a ‘beachhead’ for scaling biochar by mainstreaming it into important sectors, adding an innovative solution to address a key process need.

Innovation in Action

On October 21 and 22, process innovation was on display for all to see at the National Wood Pallet and Container Association (NWPCA) fall plant tours in Houston, Texas. Truly it was a privilege to attend, with the highlight being a tour of industrial transformation through biochar at a pilot pyrolysis facility on the site of pallet remanufacturer, 48forty Solutions.

Meet ‘Audrey’, the RAINMAKER™ pyrolyzer who came into the world just outside of Austin, Texas, as an induction-based pyrolysis machine from the environmental technology company, LOCOAL. She’s always looking for someone to feed her 8-10mm wood chip feedstock, and her favorite musical is Little Shop of Horrors.

To fill in the picture further, Audrey is just getting her final checks done onsite. She can consume two tons of feedstock per hour and produce biochar, electricity from natural gas, and bio-oil, as well as wood vinegar.

So this innovation is real, and happening now on the ground level. But let’s zoom out a minute to talk about why and how this moment is right for wooden pallet pyrolysis to create biochar.

Why Pallets? Why now?

For background, the pallet industry literally supports shipments of goods that we all depend on for daily living. Most goods that travel for mass delivery happen on the top of a wooden pallet – in the United States 1.8 billion pallet units are in circulation, 92% of which are wood, and 500 million are manufactured each year. The estimated value of the wooden pallet industry is $20 billion in 2025. Over 2500 firms are listed by the US Census as “Wooden Container and Pallet Manufacturers”¹; with a prevalence of small and mid-sized businesses. While there are several large firms, the data suggest that the industry is not highly concentrated relative to other industries.²

Sustainability is on the forefront of wooden pallet companies’ minds: though 95% of wooden pallets are recyclable, the industry generates 500,000 tons of landfill wood waste in the form of unusable, unrecyclable pallets.³ While a 2020 study concluded that wooden pallets have a (marginally) better carbon footprint relative to plastic pallets, the wooden pallet industry sees a need to innovate for sustainability. To that end the NWPCA achieved UL certification for a wooden pallet Environmental Product Declaration (EPD) in July 2020.

In that light, how to dispose of unusable wooden pallets is a key consideration. Some companies sell ground-up wood waste wood as mulch or use in fiberboard and boiler fuel. However, the economics of the market for these end uses may not be favorable depending on the recycling site dynamics – with over 2500 companies in various geographies, there is significant variability as to how viable those end-use markets are to any individual company. Sending large quantities of wood waste outright to a landfill requires paying a tipping fee as well, making that a less attractive option from a financial and climate perspective.

With these trends in mind, additional revenue streams or opportunities to derive value from supply chain waste can confer a competitive advantage to pallet companies.

Enter biochar.

Why Biochar? Why now?

Biochar is having a moment as a high-growth field, and efforts are afoot to accelerate biochar carbon removal through industrial integration, with many sessions dedicated to that prospect at the US Biochar Initiative 2025 North American Biochar Conference.

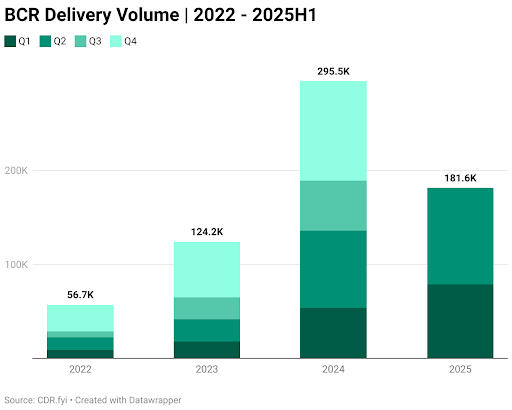

The biochar production industry is growing rapidly worldwide, with deliveries of biochar carbon credits doubling each year from 2022 to 2024. As a consequence, biochar has become by far the most commonly delivering carbon removal method according to CDR.FYI.4

Biochar pyrolysis equipment manufacturers are benefiting from credit delivery growth, and are expanding their offerings to service more industrial biochar producing clients. With this future in mind, the market value of industrial scale equipment manufacturers is forecasted to grow at an over 11% combined annual growth rate from 2024 to 2028.

Integrating into existing industries by finding innovative use cases has been a key question for the biochar industry for many years (see this 2021 AirMiners event on exactly that topic). The difference now is that instead of biochar entrepreneurs looking at innovative use-cases for its end products, the industry could advance by creating innovative pathways to embed the practice of biochar production into existing verticals for developing projects.

Achieving an adequate return on investment for intrapreneurs and their companies is the key step.

The Business Case

In short, biochar has the opportunity to turn a waste from a cost to a more substantial revenue generator.

Pyrolysis that creates biochar from wood waste can rely on multiple revenue streams:

-

- Energy generation revenue from the pyrolysis process, especially with Federal 48E tax credits for bioenergy in the US under certain conditions5

- Sales of physical biochar for customers to use or build into their own products.

- Tipping fees if the pyrolysis site is permitted to receive municipal solid waste (MSW) or construction and demolition wood waste (C&D)

- Carbon revenue, from either

- Offsetting where the carbon credit – and environmental benefit value – is sold to an entity separate from the physical char purchaser.

- Insetting where the carbon benefit and the char are bundled together and sold to a single company to address their supply chain Scope 3 emissions

As an added bonus, pallet producers as established businesses could have access to debt financing for project development that eludes many smaller biochar startups.

In that light, biochar players can see a ready-made partner with wooden pallet companies for growth. Across the wooden pallet industry, pallet producers can ‘hire’ biochar for the job-to-be-done: sustainable wood waste management.

What is the Next Milestone?

Significant opportunity exists here at the intersection of these two industries, and innovation in business models is a key driver.

On the one hand, larger pallet recyclers could purchase pyrolysis units themselves, and deploy at different sites where doing so is economically viable and technically feasible. Alternatively, groups of smaller local pallet companies may form joint ventures or special purpose vehicles (SPVs) which could pool financial resources and establish a mutual pyrolysis site to collect feedstock across several sites. They could also potentially coordinate with regional biochar networks to share best practices.

The most critical aspect of innovating within the industry at this point is to establish a core group of leaders dedicated to advancing the practice of pyrolysis. The ‘Early Adopters’ can provide examples and teaching for the industry, so that others can learn of the successes, challenges, and opportunities experienced at the early stages.

Fortunately we know many of those folks already:

Missing: Max Ross (Atlas Pallet) Tom Miles (former Executive Director, US Biochar Initiative)

A Final Word (for now)

The pallet story is only now starting to be written, and I will likely take this up in future writings. In this way, other industries interested in pursuing carbon financing can use the learnings here as an example of how to integrate carbon removal into their everyday business practices. For by doing so, I believe that the practice of removing excess carbon dioxide from the sky by any method can reach new heights.

More to come – onwards!

Many thanks to the NWPCA for hosting an excellent event, to Jess Bonsall at 48forty Solutions, Miles Murray and Matt “Petey” Peterson at LOCOALfor the site tour, and Kat Vasquez from Oxnard Pallets (an AirMiners BootUp graduate!) for making the many, many introductions to the wooden pallet community.

Jason Grillo is the Principal of Earthlight Enterprises marketing and carbon finance consultancy, Co-Founded AirMiners, and is a voluntary contributor to CDR.FYI. The opinions expressed in this writing are the author’s own and do not reflect the position of any employer, client, or associated organization. This post also appears on the blog of the Institute for Responsible Carbon Removal.

1NAICS code 321920

2HHI value of 88.1 in 2022, per census.gov

3Source: NWPCA: https://www.palletcentral.com/page/LandfillAvoidance, assuming average of 40lbs per wooden pallet

4Disclosure: I am a voluntary contributor to CDR.FYI

5For an analysis of conditions of eligibility for 48E, see this from PWC: https://www.pwc.com/us/en/services/tax/library/pwc-final-regulations-clarify-rules-for-section-48-tax-credit.html#:~:text=The%20proposed%20and%20final%20regulations%20define%20qualified%20biogas%20property%20as,that%20is%20qualified%20biogas%20property.