Markets move at the speed of trust. Durable carbon removal needs to create more of it to attract new customers and accelerate the market.

Hey folks, glad you made it here!

I’m going to say a quiet part out loud: if a customer doesn’t buy from you, it’s because they don’t trust you to deliver value for them for the price, relative to other options.

As it is still a young industry, carbon removal struggles with finding new customers; in a new market, and new offering, to a new customer who has never purchased the class of product before, trust is crucial. “New” can generate attention, but “trust” makes business happen, and carbon removal project developers – and the intermediaries they work with – have to overcome many, many barriers to earn that trust.

This operates on three levels:

- Enticing customers to trust the class of product or service

- Reaching mutual understanding of terms that the customer trusts under a contract

- Demonstrating operational credibility to deliver based on that agreement

I want to talk about how the market for durable carbon removal can advance through reducing risks and making trust happen.

Symptoms

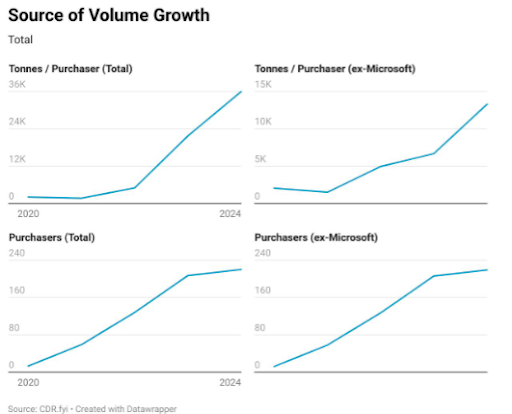

The chart presented here at Carbon Unbound East Coast from Alexander Rink at CDR.FYI¹ shows the problem: a slowing rate of new customers entering the market to purchase credits, with more than 70% of the purchase volume from Microsoft alone.

Durable CDR is running out of early adopters and has not yet broken through to a different group of more mainstream customers – who have a lower risk tolerance and are less likely to trust novel methods to achieve their business goals.

Bluntly, this represents a failure to achieve trust among new customers who have never purchased durable carbon removal credits.

Digging deeper, the story is a bit more nuanced. Operational credibility (#3 above) is there: Microsoft purchases that are breaking through with large multimillion ton deals by large scale project developers, who have resources to execute well using carbon removal technologies that are well understood such as BECCS and biochar. Considering the agreements strictly within durable CDR, this is low risk / high trust.

For both Microsoft and non-Microsoft customers, volumes per purchase are increasing – showing that yes they trust that the carbon removal works well if they have purchased already.

Beyond Microsoft and the Frontier group of companies, customers who have never purchased carbon removal are not seeing value for the price required by suppliers, even when factoring in co-benefit narratives. “No sale” is more trustworthy than a purchase. Not that new customers necessarily believe that any particular project might fail – I don’t believe that trust is absent, there’s just not enough of it for a new customer to address their own business risks. For sustainability managers with limited internal political capital, their trust is best placed in projects outside of carbon removal, or even outside of offsets generally, or with inaction.

Even in setting a Net Zero target, the unknowns for any future technology are a challenge, as suggested in this chart from SBTi:

Though this data is from March of 2024, in 2025 placing trust for new technologies is even more difficult in a macroeconomic environment that today is rife with uncertainties.

For existing CDR customers: Continue to improve trust in CDR

Right now the remedy for a lack of trust are a host of diligence exercises at the project by project level. Registries, marketplaces, insurance, ratings agencies, and external consultants hired by purchasers all will look at a project before final signatures go on paper. To say nothing of legal teams who would review new types of contracts covering a new class of credit.

I’m *not* arguing that we should throw these diligence activities out the window at all: they are necessary to build trust for those who already want to pursue a carbon removal purchase. But as the current best practice for trustbuilding, their existence represents table stakes for transactions to occur for those who are interested in going forward, however aren’t inspiring more new customers to place their trust in durable CDR.

This establishes a good baseline of trust at the level of convincing those who are interested to begin with to trust that a project is credible.

Prospective customers: Increase trust to purchase

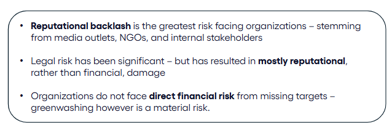

My recommendation: look to higher systemic activities that fit into existing frameworks for new customers. We know from a survey of sustainability professionals by Verdantix that firms do not pay much of a financial penalty for missing net-zero targets, and that the chief risk is reputational.

So lean into ways that enable a customer to build reputational credibility in durable carbon removal as a class of product.

- First, gain acceptance of CDR methodologies among standards bodies who evaluate registries. Based on data from the Patch marketplace, the most influential is the Core Carbon Principles approval, from the Integrity Council for the Voluntary Carbon Market, which has started to apply the CCP label to millions of issued credits.

- Second: Encourage formal forums or informal peer-to-peer experience sharing among potential customers. Sustainability professionals speak with each other, yet networks of people who have made purchases of carbon removal represent an untapped resource. This would take place in the context of a broader offset conversation where durable carbon removals are a specific class of offset. Decision makers may or may not trust CDR suppliers, or if they do, it’s after many rounds of diligence.

Fence sitters are more likely to become interested in durable CDR if a colleague can vouch for the practice in the first place. Formal or informal connections among sustainability offices can create social proof among trusted peer sets for best practices – building trust in durable carbon removal.

The need is especially acute for sharing how to work with corporate procurement teams, financial leadership, and legal departments surrounding contracting. Bespoke contracts lead to bespoke contracts; systematizing standard forms of contracting for durable carbon removal leads to trust.

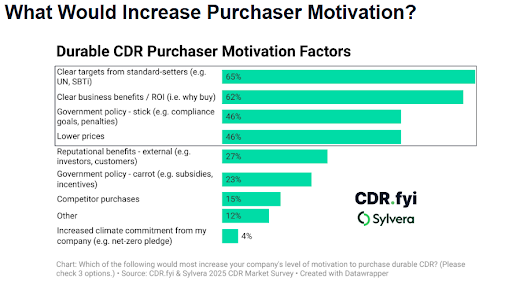

- Third: Find a way to deliver business value beyond carbon removal. This opens up another avenue to build trust: yes the sustainability claim, but showing a return on investment more clearly. This came through clearly in the CDR.FYI / Sylvera market survey of potential purchasers:

Conclusion, and Prognosis

I believe that the problems behind carbon removal markets are solvable, by employing new methods of winning trust among new customers. Today, gaining trust takes a great deal of effort on behalf of carbon removal suppliers, such that fewer new purchaser organizations are coming to CDR relative to previous years. Third party standards, peer networks among fence-sitting purchasers, standard contracting, and greater publication of successes are ways to improve credibility of CDR and make markets expand.

Jason Grillo is the Principal of Earthlight Enterprises marketing consultancy, Co-Founded AirMiners, and is a voluntary contributor to CDR.FYI. The opinions expressed in this writing are the author’s own and do not reflect the position of any employer or associated organization.

¹ Thanks to Alex Rink and my voluntary contributor colleagues at CDR.FYI for their work on the presentation. To request the full presentation, see this link here