A mixed bag for CDR, depending on method

In the end of year opining about the state of CDR, there doesn’t seem to be much consensus about the trajectory of the industry: Is carbon removal coming? Going? Staying put? Tough to say. Some headlines suggest that 2025 was a bad year for CDR, while others see a brighter year in the 12 months that just concluded.

In this post I’ll break down some of the positives, some of the negatives, and offer some suggestions about what this reveals about CDR – and offer some utter speculation about 2026 and beyond as well.

So, what the heck just happened?

A Transitional Year for CDR

From this writer’s perspective, the CDR industry is undergoing the natural maturation that follows the initial ‘hype cycle’ as it dissipates. Per Nat Bullard’s January 2025 “State of Decarbonization” slide deck, there are over 500 carbon removal startups in existence. Quiet part out loud: Not all of them are going to make it.

One reason for that is that climate investing – including CDR – pulled back during 2025. However, this trend was already in place for at least a year or two prior.¹ The “Cambrian Explosion” of CDR companies for several years starting in, say, 2019 could not last: sooner or later, good ideas and standards will emerge, and less appealing solutions will suffer in the market (or at least get mothballed). Per Erik Amundson here, that might not be the worst thing: the most adaptable organizations will find a way to survive and progress.

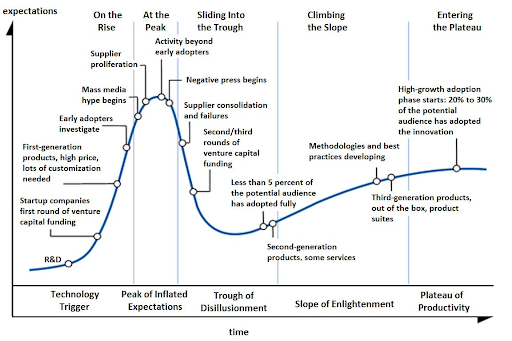

Per the Gartner ‘hype cycle’ chart, my sense is that CDR generally is past the ‘peak’, and is just about to begin the ‘sliding into the trough’

Much of the distress surrounding the state of carbon removal focuses on the fact that startups are beginning to go out of business, having not delivered carbon removal tonnage. By 2025, some investors from the 2020 to 2022 period started to expect a return, while Series A or Series B funding became significantly tougher. Not that financing events did not happen – they did – they were only tougher to come by, especially in the $1M to $5M range as noted in this Planet2050 + CDR.fyi market report.

In short, the CDR field in 2025 started to experience a ‘winnowing’; I’m going to suggest in the next section that companies that progress or are culled out might be organized by method of CDR.

Differentiation

How macro trends affect the broad industry are increasingly differentiated by the major methods that have emerged over the 5-year period from 2020-2025. I’m not saying that new, innovative solutions won’t ever step up, but as of this writing, the field seems to be sorting out among a few distinct CDR method classes.

Rather than external factors affecting all companies and all methods equally, 2025 saw increased differentiation in the fortunes of CDR project developers organized by the type of solution on offer. Policy shifts, notably in the United States, financial demands, and customer expectations did not affect all companies equally throughout 2025. I’ll recount some of the effects on sub-sectors of CDR below.

For Direct Air Capture companies, 2025 was ‘tough sledding’. The retraction of IRA funding for the DAC Hubs in the United States is causing many of the leading companies to scramble for alternate sources of financing. Or to move to other countries, such as Canada.

Biochar saw robust growth with the sector starting to achieve traction for the physical biochar produced. Registries such as Isometric and Climate Action Reserve have picked up on this trend, offering new methodologies for biochar as demand for registry services grows.

In Enhanced Weathering, the excellent news was that an ERW company – Mati Carbon – won the grand prize for the XPRIZE carbon removal competition, plus the first ever verified ERW carbon removal credits were issued. That said, the necessity of improving MRV in a complex, open system and pressures on the economics of ERW are challenges to consider for the future.

In Marine CDR, Gigablue grabbed headlines in January with its 4-year, 200,000 ton CDR deal, though the field in general still requires a good amount of scientific research and upfront development money before making good on its vast potential, similar to how the biopharmaceuticals industry operates. The key concern is the extent to which the 2024 shutdown of Running Tide more broadly affected the marine CDR investment landscape.

Market Development

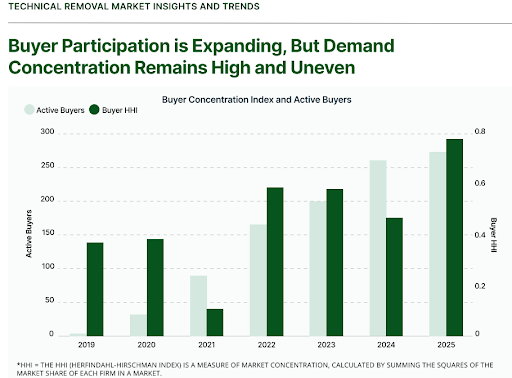

Surprise: Microsoft remains the predominant purchaser ofCDR credits!² Per Allied Offsets Voluntary Carbon Market 2025 Review below, the number of active buyers did increase – slightly – in 2025 relative to 2024. That said, why aren’t other companies stepping up?

The good news is that there was increasing interest in CDR – and climate generally – outside of the United States, especially in Asia. For example Japan has begun to be the site of more CDR activity, with Japanese corporate investors increasingly attending overseas events. My sense is that purchases of carbon removal credits by Japanese companies will advance apace as the country rolls out its GX League, as government activities can drive voluntary action. Singapore has also become a major CDR hub, as both the national government and financial sector in the country are keenly pursuing carbon removal solutions.

Second, 2025 laid bare the need for infrastructure and market tools to advance the industry. The heightened public profile of CDR at the COP conference also strengthens the case for buyers and other industry supporters. OSCAR, an initiative to launch a standard carbon removal contract applicable across all methodologies globally is an example of a catalyst that can cut through transactional friction. (disclosure: I’m a Co-Founder). As companies offering supply to the market mature, the business infrastructure supporting commercial and financial transactions will have to develop in parallel. Look to 2026 for more of such efforts.

Third, end-use applications for carbon removal projects are becoming more important. Notably, Verde Resources (a biochar-to-asphalt utilization company) announced in late December that it is registering for an underwritten public offering on NASDAQ. My stance is that CDR companies who can develop revenue-generating or cost-saving outcomes for their customers are likely to win out in the long run, providing value beyond selling a carbon credit itself.

Insetting is a key pathway to investigate; the economic value chain beyond carbon removal credits may spur adoption of CDR solutions. In that light, the practice of intrapreneurship to create value within businesses can be decisive, rather than presenting carbon removal credits as a pure expense that hits a P&L statement (and potentially affects executive compensation).

Conclusions

2025 proved to be a mixed bag for carbon removal as an industry. The accelerated dropoff in funding poses a hurdle to scale-up. The most successful project developers gained commercial traction for physical products and carbon removal credits in this difficult financing and policy environment. My take is that the general economic and policy environment will affect companies differently, dependent on what sector they are, and the prospects for revenue generation in other value chains. Some will see ceilings of success along faster or slower timelines; some will accelerate, while others plateau. The industry still has a long way to go – it’s still in its ‘tween’ or early teenage years – but has definitely established itself as a key solution in the climate landscape.

¹ Susan Su’s comments in the linked video were recorded in late 2024.

² Per CDR.fyi Purchaser leaderboard as of January 2, 2025.

Jason Grillo is the Principal of Earthlight Enterprises marketing and carbon finance consultancy, Co-Founded AirMiners, and is a voluntary contributor to CDR.FYI. The opinions expressed in this writing are the author’s own and do not reflect the position of any employer, client, or associated organization. This post also appears on the blog site of the Institute for Responsible Carbon Removal, American University.