How reframing carbon removal can be a throughline to a prosperous industry

“Knowing others is intelligence; knowing yourself is true wisdom” – Lao Tzu

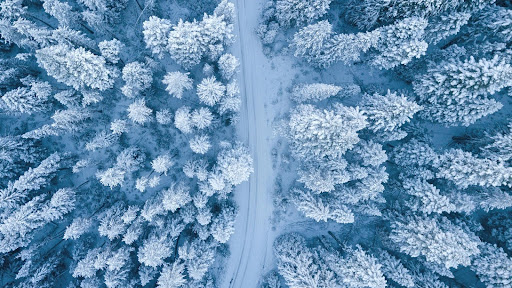

Writing this in December as indeed winter is upon us, I’ve noticed a different kind of winter that may be coming to carbon removal: a general decline of interest in sustainability and climate among corporations who would be voluntary carbon market purchasers. In this post, I’ll explore the nature of this problem, recap how corporate rollback has happened before, and offer some potential paths forward.

First, some context. While the last 5 weeks since the US election has seen climate scrambling to understand what the implications of Donald Trump’s victory might mean for policy, evidence has been piling up for approximately 18 months prior to that. ESG hiring growth is down after a crescendo from 2019-2021, and very recently large corporations such as Coca Cola and Goldman Sachs are changing course on how to deliver on sustainability targets.

Declining corporate sustainability budgets may constrict sales opportunities among more mainstream voluntary carbon market purchasers.Indeed, it appears that while targets are being set, corporations are falling short of resourcing efforts to meet those lofty goals. Additional macroeconomic changes – real or projected – such as inflation, high tariffs, or the end of Zero Interest Rate Policy may cause customers and investors to withdraw support.

For a case study in how a generation of startups might grapple with this, let’s consider lessons from “Cleantech 1.0” from approximately the mid-2000s to early 2010s. In that time period, a wave of startups created a myriad of carbon-free energy solutions – for example, solar, wind, EVs, batteries, or energy efficiency software. A scarcity of patient capital, low-priced competition from abroad, particularly China, and inconsistent government tax credit support consistently challenged companies working on solutions in these sectors.

The solar, wind, and battery startups were clear: they were not in the “alternative energy” business, they were in the energy business with the all-important Levelized Cost of Electricity (LCOE) as their benchmark. Demand for clean energy persisted and grew among energy customers, particularly due to Germany’s Feed-In-Tariff policy for solar, wind and geothermal. Support by Germany’s leadership, and experiential learning by deploying led to solar cost declines outpacing their forecasts by decades:

This enabled renewable energy companies in the early 2010s to survive – and thrive – during the ‘long winter’ for climate investment between 2011 and 2019.

Two more examples from outside climate on the practice of business re-definition, one a failure, one a success:

-

-

- Railroads. In the early years of the twentieth century, railroads were a significant player in the United States’ and world economy, moving huge volumes of goods and passengers. Today railroads occupy a fraction of the economy since automobiles, trucks, and air transportation of goods and people appeared on the scene, taking away significant market share such that many railroads had to declare bankruptcy. The railroads’ failure: defining themselves too narrowly as railroad companies, not more broadly as transportation companies (For more on this see Theodore Levitt, “Marketing Myopia”).

- Professional wrestling. Yes, I watched my fair share of the spectacle on TV during my (awkward) junior high school years. What I didn’t realize then was that I was witnessing a redefinition of a business that decades later has thrived and grown. How? A philosophical shift in how they defined their business: specifically, the owner of the then-World Wrestling Federation quipped once that they are in the “sports entertainment” business rather than the wrestling business – that is, oriented to the customer rather than the process of wrestling itself. Nearly forty years later, World Wrestling Entertainment had revenue of over $1.3 billion.

-

To be clear, I am NOT suggesting that CDR startups become ‘climate entertainment’ companies! However I believe that companies who are developing solutions intended primarily to help the climate struggle to define their business in a broader industrial context to that frame them well for success with future customers in the event of a climate tech ‘winter’.

In short, consider the thought that ‘climate’ is not an industry: it’s an umbrella term for technology and business innovations spanning a wide variety of industrial sectors, that happen to yield low or negative emissions.

For many carbon removal project developers, defining along industrial lines means redefining what business they are in, and figuring out who their customer is, so they can craft a solution in a time that may be challenging in the short term. Doing so could lead to solutions that are able to penetrate existing industries with better/faster/cheaper products and improve climate health as a secondary – and still very important – benefit.

Finding a customer who can utilize the physical product or by-product of carbon removal would integrate carbon removal processes into a larger economy beyond credit sales alone. Deploying the technology for an end-use would generate customer revenue and also lead to cost improvements with experience, per Wright’s Law.

Internally CDR businesses should talk about themselves in terms beyond what they can do for climate. This can happen in founders meetings, with investors, with marketing partners and others who they deal with to bring their solutions to market. And in doing so develop solutions that, for example:

…produce a soil amendment or improve soil health = “we’re in the business of helping farmers deliver high quality food cheaply to consumers”

…generate energy in rural areas = “generating heat or electricity to places that may suffer energy scarcity”

…combine with building materials = “make it easier for homes or roadways to be built”

…use agricultural waste as a feedstock “ease the burden of disposal owners of agricultural land”

…create gases for fuel or specialty chemicals “enabling the new energy and materials economy”

Carbon removal business leaders can see beyond a purely technical definition of their product, retaining personal motivations to do well for the climate while seeking commercial markets that may not have climate as top-of-mind. Key question: In the possible absence of policy interventions or without carbon credits, how would a bottom-line motivated customer buy a solution to help their own business needs?

What about carbon removal crediting? Offset crediting is still an option if there is sufficient interest among voluntary purchasers – this is still a relevant pathway to viability. That said, companies could decrease unit cost curves by pursuing insetting to deploy more projects, and in doing so lower their internal costs to enable creating offset credits for sale in the voluntary market.

Ultimately, compliance markets will be where carbon removal will see its greatest impact on climate, offering a dynamic quite different from motivations of voluntary carbon market customers. Redefining the business along a utilization pathway is a way of seeing a generation of carbon removal startups through to that time. Figuring out the fundamental business that a CDR company is pursuing could safeguard against market uncertainties as corporate sustainability interest waxes and wanes.

Jason Grillo is a Co-Founder of AirMiners. The opinions expressed in this writing are the author’s own and do not reflect the position of any employer.